Thinking about buying a home, but not sure how to afford it? Welcome to the Down Payment Diaries, where real people spill about how they saved and splurged on their path to homeownership. If you’d like to submit your own Down Payment Diary, please fill out the form here.

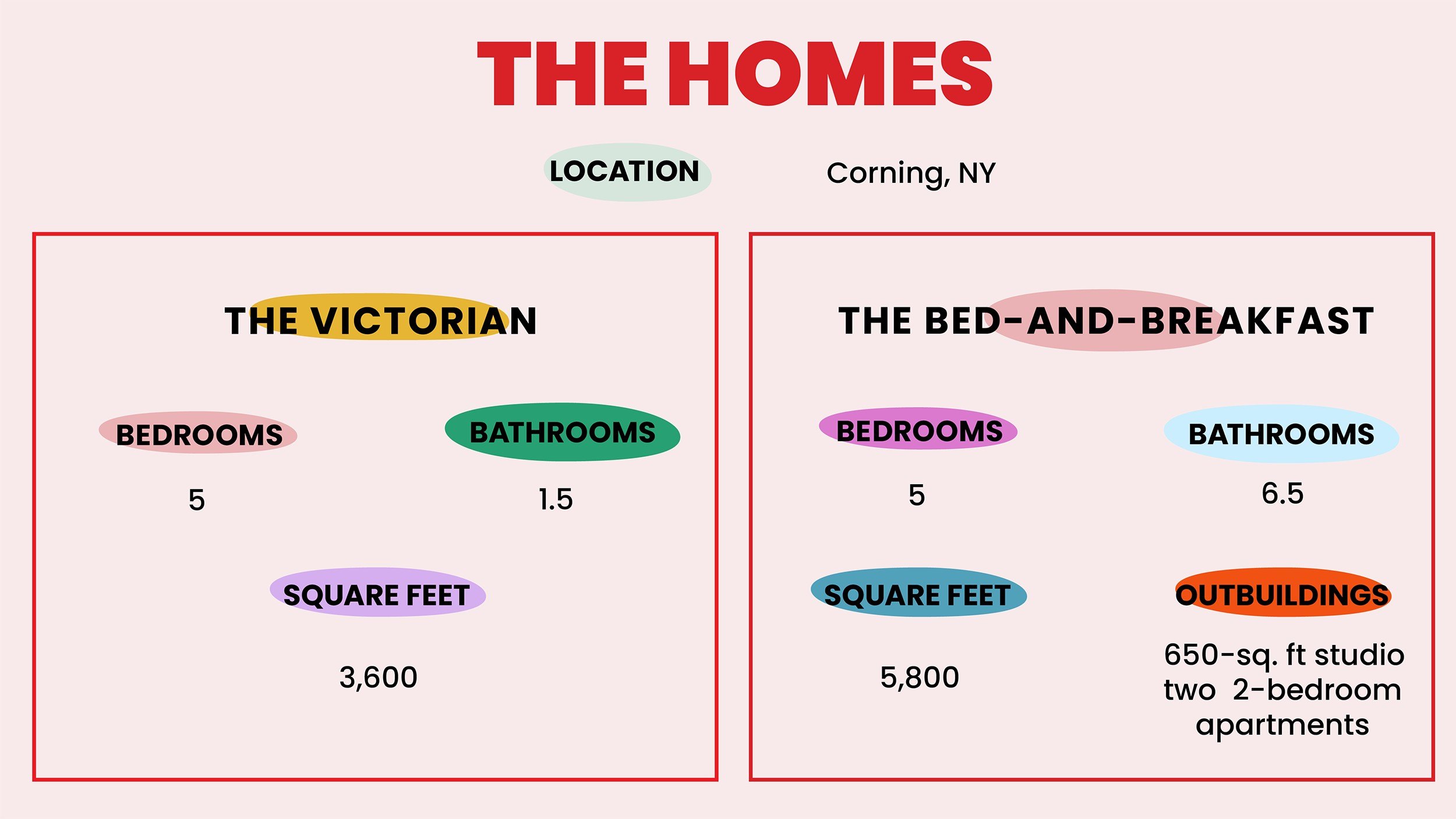

Today, a couple relocates from California to upstate New York, falls in love with a Victorian home then buys the bed-and-breakfast next door.

The basics

Age: 43

Marital status: Married

Occupation: Realtor®

What was your home experience when you were growing up?

My parents always owned the homes we lived in, but we relocated often. I’ve lived in so many homes, which is a piece of why I wanted to buy. Homeownership feels like stability. Plus, historically, it’s proven to be a good investment.

Why did you start thinking about buying?

My husband’s family lives in southern Vermont. They’re getting older, and we wanted to be closer to them. Then my husband stumbled on an opportunity at work that would transfer him from California to upstate New York.

What was the house-hunting process like?

My husband’s company gave him a lot of flexibility in terms of where in the state he could live, so we started off looking in Rochester, Syracuse, and Buffalo. We looked at more than 200 houses online, and more than 20 in person. We actually made an offer, sight unseen, on a place in Little Falls, N.Y. (Our offer wasn’t accepted and weeks later we had the chance to drive there and see that we had dodged a bullet on that one.)

What were your non-negotiables?

We wanted something unique that spoke to us. My husband works from home and needed a good office. I needed it to be walkable, so I was looking at the walkability score. We also wanted a yard, ideally already fenced in or ready to be fenced in for our dogs.

How did you end up finding this home?

We hadn’t even planned on looking at homes in the small city of Corning, but my husband wanted to take a day trip to the glass museum there. It’s famous and even has its own Netflix show called “Blown Away.” That night in the hotel, we pulled up Realtor.com® and happened to find the listing for this house.

How did you know this was the one?

It was an instant, “Wow.” Right away, we emailed the listing agent to see it. It was vacant, so we saw it the next day. We loved it so much we canceled our plans to see any other homes. We also loved the vibe of the town, just two blocks from our house. We have bars, restaurants, shops, and a library all within walking distance.

Was it what you expected to find?

My husband and I had been living in a modern, stucco-exterior home in California. We consider ourselves minimalists, and never thought we would fall in love with an ornate, Victorian-style home, but we did. This home has beautifully carved woodwork and super high ceilings.

How did you decide to buy the house next door?

When we first looked at the house we bought, we saw that the house next door was for sale. It had been a bed-and-breakfast since the 1980s. We closed on our home; it was still for sale. Clearly nobody was in a rush to buy it. We loved our home so much, and we know that a bad neighbor has the potential to change your whole experience. Our fear was that someone would have turned it into a down-market, eight-unit apartment complex.

What did you have in mind?

For years, my husband and I had been toying with the idea of real estate investing. When we moved, I left my job as a marketing manager of a bike company. I was taken with the idea of owning this place and turning it into three Airbnbs. I saw that my job could become managing the renovations and then managing these rental properties.

Where did the down payment come from?

We sold our house in California. That gave us enough cash to afford a down payment on a home.

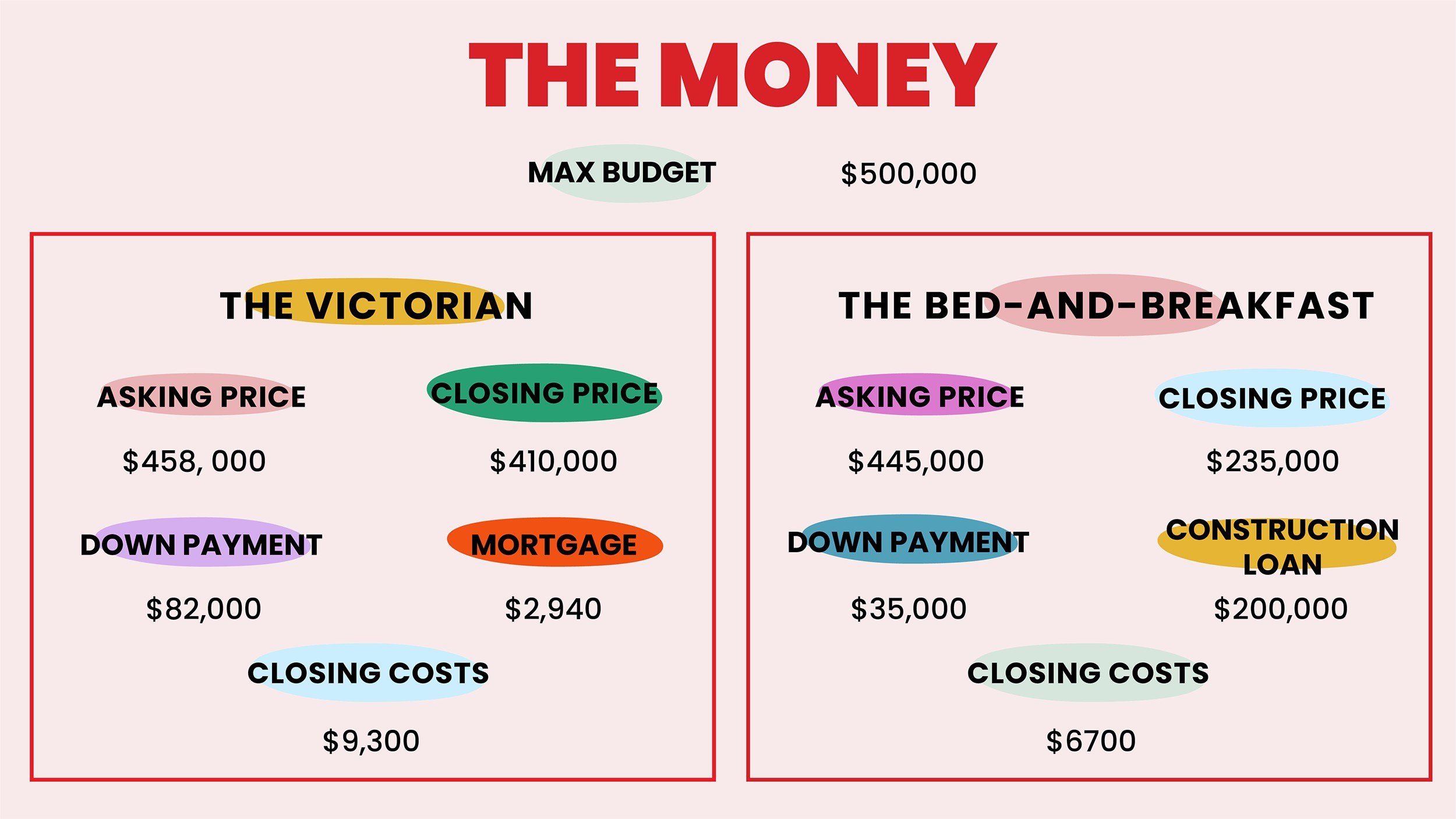

How did you decide on your budget of $500K?

We were originally looking in the $700,000 price range, but the property taxes in New York are high. They’re almost double what they would be somewhere else. That took our purchase price down to $500,000.

How did you decide on your offer price?

This house had been listed for a long time and was vacant. It had originally been listed at $530,000. I had recently become a Realtor and knew how to dig around to find the number we needed to start with. I pulled up the homes that had recently sold and calculated what they were getting per square foot. All the other historic homes that had sold had several bathrooms, and this home only had one, which I knew was significantly affecting its desirability. I knew we had room for negotiation.

Were there any surprises with the home?

The house was in pretty good shape when we bought it. We did have to put in a radon system right away due to the fact that the granite foundation was releasing levels of radon 10 times the recommended limit. We also had to fix some plumbing leaks and have to do some roof repairs and add gutters. But, all in all, it didn’t need much work.

What did the numbers look like on the second property?

This property had originally been listed at $545,000. When we saw it, they had dropped the listing price to $445,000. We made a low offer, which led to weeks of back-and-forth negotiations. We settled on $325,000, and then our home inspector came. He found more stuff that needed work. The house needed a new roof. The basement was full of asbestos. The heating system had an outdated system that relied on a big water tank on the top floor, rather than an updated pressure system. The previous owners installed a new boiler, but it was piped through the old boiler, which made no sense. You could tell that the previous owners had done updates, but everything had been done cheaply, and a lot of it needed to be redone. Knowing all of that, we were able to negotiate the purchase price down to $235,000. We put $35,000 down, which we had thanks to the sale of the California home, and then we took out a $200,000 construction loan.

How soon will you be able to start renting it out?

We are renting out the main house as well as one short-term rental unit. The apartment over the garage was renovated in 1990, so that seemed like low-hanging fruit. We had to rip up the carpet and install new electricity, but we think that unit should be ready within two months to be rented out on Airbnb. We’ve run the numbers, and once all the units are completed they should gross $120,000 a year.

What has it been like to adjust to life in a small town?

I love it. Every day, I am just so happy. It’s so different to not have to drive everywhere and be stuck in traffic. In California, we had a gas station a mile away, but that was it. Here, we walk to town every day, whether that’s to go get ice cream or a cocktail.